The landscape of cryptocurrency is constantly evolving, a whirlwind of innovation, technology, and speculation. As we step into a future punctuated by digital currencies like Bitcoin (BTC), Dogecoin (DOG), and Ethereum (ETH), one undeniable trend stands out: the rise of mining machine hosting services. With the complexities of mining becoming more pronounced, these services offer a lifeline not only to individual miners but also to large-scale operations looking to thrive in this competitive environment.

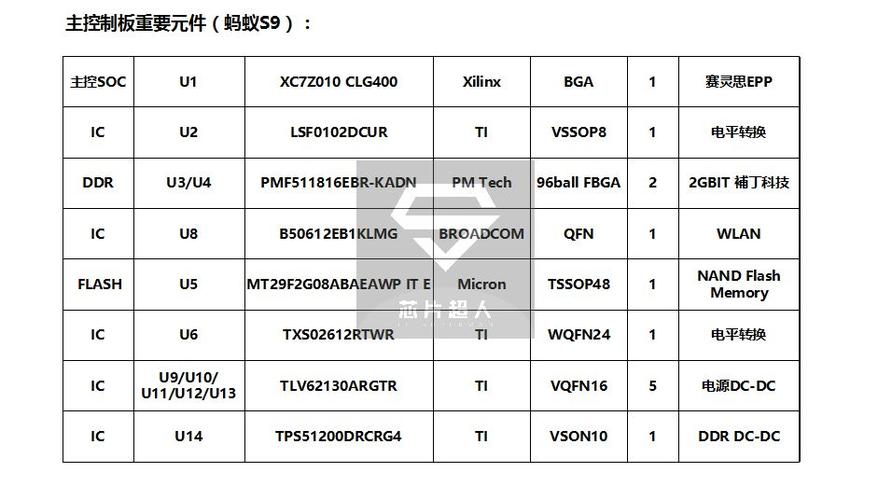

Mining has transformed dramatically since Bitcoin first emerged in 2009. Early adopters could mine using standard personal computers, but today, specialized hardware—known as mining rigs—are imperative for anyone serious about earning cryptocurrency rewards. These mining machines, engineered for efficiency and speed, dominate the landscape, leading to a new phenomenon: mining machine hosting facilities. In these high-tech environments, miners can rent space for their machines, enjoying benefits such as reduced electricity costs and enhanced cooling systems.

Looking ahead to 2025, several key trends are shaping the future of mining machine hosting services. One of the foremost directions is the increasing emphasis on sustainability. The cryptocurrency industry has faced scrutiny over its environmental impact, particularly concerning energy consumption. As regulations tighten and the public becomes more environmentally conscious, hosting services will likely adopt greener technologies and energy sources, such as solar or wind power. The push for cleaner mining operations will not only enhance the industry’s image but also reduce operational costs in the long run.

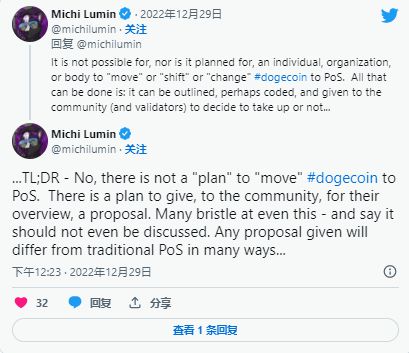

Furthermore, diversification in cryptocurrency mining is another emerging trend. While Bitcoin remains the king of cryptocurrencies, the rise of altcoins, including Ethereum and even meme coins like Dogecoin, is hard to ignore. This expanding digital currency universe means that hosting facilities will need to adapt, offering setups that can support a range of mining configurations tailored to different coins. With the Ethereum 2.0 transition to a proof-of-stake model, new opportunities are rising for hosting services to cater to investors looking to stake rather than mine.

Security, too, is becoming a cornerstone of hosting services. With the rise of cyber threats, from hacks to data breaches, the need for fortified infrastructures is paramount. Hosting companies are expected to integrate advanced security protocols, offering encryption, multi-factor authentication, and robust firewalls. This heightened security not only protects operational integrity but also instills confidence in clients who are storing significant assets in these facilities.

On the horizon also looms the impact of regulation. As governments around the globe start to carve out frameworks for cryptocurrency use and mining, hosting services will need to anticipate and comply with these new laws. This regulatory landscape will influence everything from operational practices to financial reporting, affecting how businesses operate at each level of the mining process. Companies excelling in compliance may find themselves at a significant competitive advantage, able to assure clients of their legitimacy and reliability.

The year 2025 is not just about technology and practices; it’s also about the community cultivated around cryptocurrency and mining endeavors. Hosting services will increasingly foster partnerships with clients, promoting knowledge sharing and educational resources. Workshops, webinars, and community events can unite miners, informing them about the latest advancements or regulations while also strengthening ties. Enhanced customer service, driven by a better understanding of users’ needs, will emerge as a significant differentiator in an increasingly crowded market.

Lastly, the influx of institutional investment in cryptocurrency presents both challenges and opportunities for mining services. As more financial entities explore digital currencies, the demand for scalability and operational excellence in mining hosting will flourish. The trend may lead existing facilities to expand, while new players will emerge, striving to secure a position in this burgeoning industry. How well hosting services adapt to meet these needs will shape their success as we approach 2025.

The journey of mining machine hosting services is one of adaptation and innovation. As trends emerge and evolve—a focus on sustainability, diversification of mining operations, heightened security, regulatory compliance, and a growing community interaction—industry players must remain agile. The dynamism of the cryptocurrency market, fueled by its digital revolution, will keep everyone involved on their toes, necessitating a forward-thinking mindset. As we navigate the expanse leading up to 2025, one certainty remains: the evolution of mining machine hosting will continue to captivate both industry veterans and novices alike.