The digital gold rush is upon us, and the pickaxes of choice are no longer traditional shovels, but rather sophisticated mining machines. As Bitcoin and other cryptocurrencies continue their ascent, the allure of passive income through mining grows stronger. However, the reality of setting up and maintaining a profitable mining operation can be daunting. Enter: mining machine hosting services – your gateway to revolutionized crypto earnings.

Imagine sidestepping the complexities of hardware acquisition, noisy setups in your garage, and the constant battle against overheating. Mining machine hosting takes all that off your plate, offering a streamlined solution for both crypto novices and seasoned veterans. But what exactly does it entail, and why is it becoming the preferred method for maximizing your mining potential?

At its core, mining machine hosting involves entrusting your mining rigs to a specialized facility. These facilities, often located in regions with access to cheap and reliable electricity, provide the ideal environment for optimal performance. Think of it as a data center specifically tailored to the energy-intensive demands of cryptocurrency mining. They handle everything: securing your machines, maintaining optimal temperature and humidity, ensuring consistent power supply, and providing round-the-clock monitoring and technical support.

The benefits are multifaceted. Firstly, the economies of scale achieved by these large-scale operations translate into significantly lower electricity costs – the single biggest expense in mining. Secondly, professional-grade cooling systems prevent overheating, extending the lifespan of your valuable hardware and maximizing hash rates. Thirdly, robust security measures safeguard your equipment from theft and unauthorized access. Finally, 24/7 technical support means any issues are promptly addressed, minimizing downtime and maximizing your earnings.

Beyond the practical advantages, mining machine hosting democratizes access to the world of crypto mining. No longer do you need a hefty upfront investment in infrastructure to participate. You can simply purchase a mining machine, ship it to the hosting facility, and start earning immediately. This lowers the barrier to entry and allows individuals with limited resources to tap into the lucrative potential of cryptocurrency mining.

Choosing the right hosting provider is crucial. Factors to consider include the facility’s location (electricity costs are paramount), uptime guarantees (minimizing downtime is key), security protocols (protecting your investment), and customer support reputation (prompt and helpful assistance). Don’t be afraid to ask questions and do your due diligence. Compare pricing models, bandwidth offerings, and maintenance schedules to find a provider that aligns with your specific needs and goals.

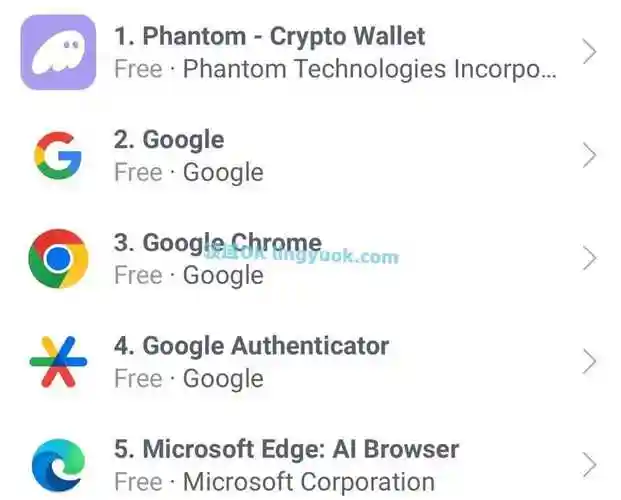

The landscape of cryptocurrencies is ever-evolving. While Bitcoin remains the king, the rise of Ethereum, Dogecoin, and countless other altcoins has created a diverse and dynamic mining ecosystem. Many hosting providers offer support for a wide range of cryptocurrencies, allowing you to diversify your mining portfolio and capitalize on emerging opportunities. Explore the possibilities and consider which coins offer the most promising returns based on current market trends and mining difficulty.

Mining machine hosting is not a “get rich quick” scheme. It requires careful planning, research, and ongoing monitoring. However, with the right approach and a reliable hosting partner, it can be a powerful tool for building a sustainable stream of passive income in the exciting world of cryptocurrency. Embrace the revolution, harness the power of mining machine hosting, and unlock your crypto earning potential.

Consider the energy consumption and environmental impact of mining. Look for hosting providers that prioritize sustainable energy sources and implement eco-friendly practices. Responsible mining is essential for the long-term health of the cryptocurrency industry.

From ASIC miners dedicated to Bitcoin to GPU rigs optimized for Ethereum and other algorithms, the right hardware is essential for maximizing your returns. Mining machine hosting gives you access to professional-grade facilities designed to support the latest and most efficient mining equipment. This ensures you’re always operating at peak performance and staying ahead of the curve.

The future of cryptocurrency mining is undoubtedly intertwined with the rise of professional hosting services. As the industry matures and competition intensifies, the advantages of outsourcing your mining operations will only become more pronounced. Embrace the efficiency, security, and scalability of mining machine hosting and position yourself for long-term success in the digital gold rush.

Don’t forget the tax implications! Consult with a qualified tax professional to understand your obligations and ensure compliance with all applicable regulations. Proper financial planning is crucial for maximizing your profits and minimizing your risks.

Ultimately, the decision of whether or not to use a mining machine hosting service depends on your individual circumstances and goals. However, for many individuals and businesses, the benefits outweigh the costs. By outsourcing the complexities of mining to a specialized provider, you can focus on what matters most: growing your crypto earnings and participating in the exciting evolution of the digital economy.