In the ever-evolving landscape of cryptocurrency mining, optimizing mining machine hosting has become a pivotal strategy for maximizing gains. As the digital gold rush continues, with Bitcoin leading the charge, savvy investors and operators are turning to dynamic approaches that blend technology, strategy, and foresight. Hosting mining machines isn’t just about plugging in hardware; it’s an art form that demands adaptability to fluctuating market conditions, energy costs, and technological advancements. By focusing on efficiency and innovation, users can turn their investments in machines like those offered by our company into lucrative ventures, whether mining Bitcoin, Ethereum, or even the whimsical Dogecoin.

Let’s delve into the core of Bitcoin mining first, where the stakes are high and the rewards substantial. Bitcoin, or BTC, remains the kingpin of cryptocurrencies, its blockchain demanding immense computational power. Optimizing hosting for BTC involves selecting data centers with robust cooling systems and low-latency networks to handle the Proof-of-Work consensus mechanism efficiently. Imagine rows of powerful mining rigs humming in a climate-controlled facility, their ASICs crunching hashes at breakneck speeds. But dynamism enters the picture when operators adjust hosting based on network difficulty; for instance, during a hash rate surge, relocating machines to regions with cheaper electricity can slash costs dramatically. This fluidity not only boosts profitability but also ensures resilience against the volatile crypto market.

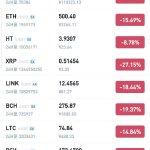

Shifting gears to Ethereum, or ETH, the narrative changes as we move towards more energy-efficient models. With the recent transition to Proof-of-Stake, ETH mining has evolved, reducing the reliance on traditional rigs and emphasizing staking through hosted wallets. Yet, for those still using mining machines, hosting optimization means integrating renewable energy sources to align with ETH’s eco-friendly ethos. Picture a modern mining farm where solar panels power sleek miners, dynamically scaling operations based on ETH’s gas fees and network congestion. This approach not only cuts environmental impact but also enhances long-term gains by future-proofing against regulatory pressures, making it a smart play in the broader crypto ecosystem.

Now, let’s not overlook the fun side of cryptos like Dogecoin, affectionately known as DOG. Born from internet memes, DOG has surged in popularity, attracting a new wave of miners who seek quick, albeit unpredictable, profits. Hosting for DOG involves lightweight rigs that can handle its less intensive algorithm, allowing for dynamic adjustments like overclocking during price pumps. In a world where viral trends can skyrocket a coin’s value overnight, optimizing hosting means being agile—perhaps migrating machines to cloud-based solutions for instant scalability. This burst of activity underscores the importance of diverse strategies, blending humor and high-tech to ride the waves of meme-driven markets.

Beyond specific currencies, the concept of mining farms plays a crucial role in overall optimization. A mining farm is essentially a centralized hub where multiple machines operate in harmony, and dynamic approaches here include automated monitoring systems that detect inefficiencies in real-time. For instance, if a farm’s cooling system falters, AI-driven adjustments can reroute power to prevent overheating, ensuring uninterrupted mining of assets like BTC or ETH. The richness of this setup lies in its scalability; operators can expand or contract based on market bursts, turning a simple farm into a fortress of gains. Our company’s hosting services excel in this area, providing state-of-the-art facilities that adapt to your needs.

At the heart of it all are the miners themselves—both the human operators and the machines. A miner’s journey involves selecting the right hardware, like our top-tier rigs designed for versatility across BTC, ETH, and DOG. Dynamic optimization means regularly updating firmware, experimenting with overclocking, and integrating with exchanges for seamless asset trading. Sentence structures vary here: short, punchy commands like “Monitor closely!” contrast with elaborate explanations of how these tweaks can amplify returns during bullish runs. The unpredictability of crypto demands this rhythm, where one moment you’re fine-tuning for energy savings, and the next, you’re scaling up amid a market explosion.

Finally, as we wrap up, remember that mining rigs are more than just tools; they’re gateways to financial empowerment. By embracing dynamic hosting strategies—such as predictive analytics for energy costs or diversified currency portfolios—users can navigate the choppy waters of Bitcoin, Ethereum, and beyond with confidence. Whether you’re a novice or a veteran, the key lies in adaptability, turning potential pitfalls into profitable opportunities. In this vibrant world, gains aren’t just about luck; they’re about smart, rhythmic decisions that keep your operations thriving.