The allure of Bitcoin, that digital gold shimmering in the digital ether, continues to captivate investors and tech enthusiasts alike. But beyond the headlines of surging prices and celebrity endorsements lies the gritty reality of mining – the computational heavy lifting that underpins the entire cryptocurrency ecosystem. And for those seeking to carve out a significant slice of the mining pie, the question isn’t just *if* to mine, but *how* to scale effectively. This often leads ambitious miners to look eastward, to the manufacturing heartlands of Asia, for bulk purchasing opportunities.

Navigating the world of cryptocurrency mining can feel like traversing a labyrinth. From understanding complex algorithms to deciphering the nuances of hardware optimization, the learning curve is steep. But for those with the ambition and the resources, the rewards can be substantial. The key to success, particularly in a competitive market, is efficiency. And that efficiency often begins with acquiring the most powerful and cost-effective mining hardware available.

Asia, particularly China, has long been the epicenter of cryptocurrency mining and manufacturing. This concentration has fostered a unique ecosystem of suppliers, component manufacturers, and technical expertise. Purchasing mining rigs in bulk from Asian suppliers offers several distinct advantages. Firstly, cost. The sheer volume of production allows for economies of scale that are simply unmatched elsewhere. Secondly, access to cutting-edge technology. Asian manufacturers are often at the forefront of developing and deploying the latest generation of mining ASICs (Application-Specific Integrated Circuits), offering superior performance and energy efficiency.

Beyond Bitcoin, the landscape of cryptocurrencies is incredibly diverse. Ethereum, with its shift towards Proof-of-Stake (PoS), presents a different kind of opportunity, albeit one less focused on traditional mining hardware. Dogecoin, initially a meme coin, has demonstrated surprising resilience and market appeal, highlighting the unpredictable nature of the crypto market. And then there are a myriad of altcoins, each with its own unique algorithm and mining requirements. Navigating this complex terrain requires a keen understanding of market trends and technological advancements.

The decision to host your mining operation is a significant one. Setting up your own mining farm requires substantial upfront investment in infrastructure, including cooling systems, power management, and security. Hosting, on the other hand, allows you to leverage the expertise and established infrastructure of a dedicated hosting provider. This can significantly reduce your capital expenditure and operational overhead, allowing you to focus on optimizing your mining operations. Hosted solutions also often provide access to more stable and reliable power supplies, a critical factor in maintaining consistent hash rates and maximizing profitability.

However, bulk purchasing from Asia also presents its own set of challenges. Language barriers, cultural differences, and logistical complexities can make the process daunting. It’s crucial to conduct thorough due diligence, establish clear contracts, and build strong relationships with your suppliers. Working with a reputable sourcing agent can be invaluable in navigating these challenges and ensuring a smooth and successful transaction. Quality control is also paramount. Verifying the specifications and performance of your mining rigs before they are shipped is essential to avoid costly delays and performance issues down the line.

The regulatory environment surrounding cryptocurrency mining is constantly evolving. Different jurisdictions have different attitudes towards mining, ranging from supportive to outright prohibitive. It’s crucial to stay informed about the latest regulations and to ensure that your mining operation is compliant with all applicable laws. This includes issues such as electricity consumption, environmental impact, and data security.

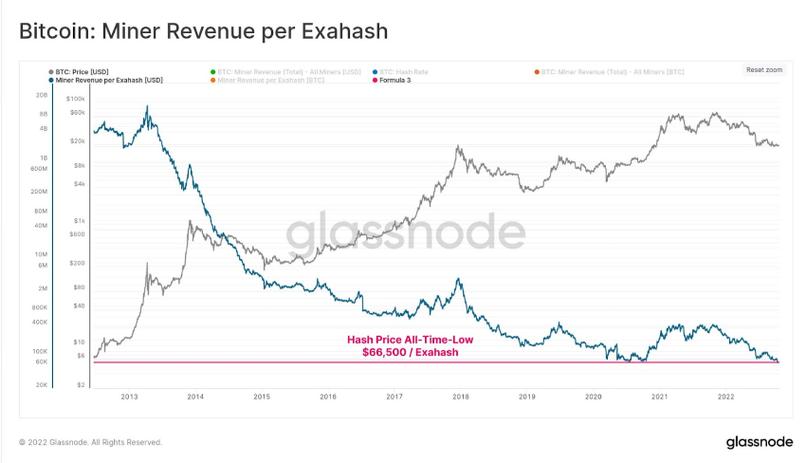

The volatility of the cryptocurrency market adds another layer of complexity to the mining equation. The profitability of mining is directly tied to the price of the cryptocurrency being mined. Sudden price drops can render even the most efficient mining operations unprofitable. Therefore, it’s crucial to have a robust risk management strategy in place, including hedging strategies, diversification of mining activities, and a clear understanding of your break-even point.

In conclusion, scaling your Bitcoin mining operation through bulk purchasing from Asia can be a highly effective strategy for achieving economies of scale and gaining access to cutting-edge technology. However, it’s a complex undertaking that requires careful planning, thorough due diligence, and a deep understanding of the cryptocurrency market and the global supply chain. By mitigating the risks and leveraging the opportunities, ambitious miners can position themselves for long-term success in the ever-evolving world of cryptocurrency mining.